Introduction to the Volume Price Trend (VPT) Indicator:

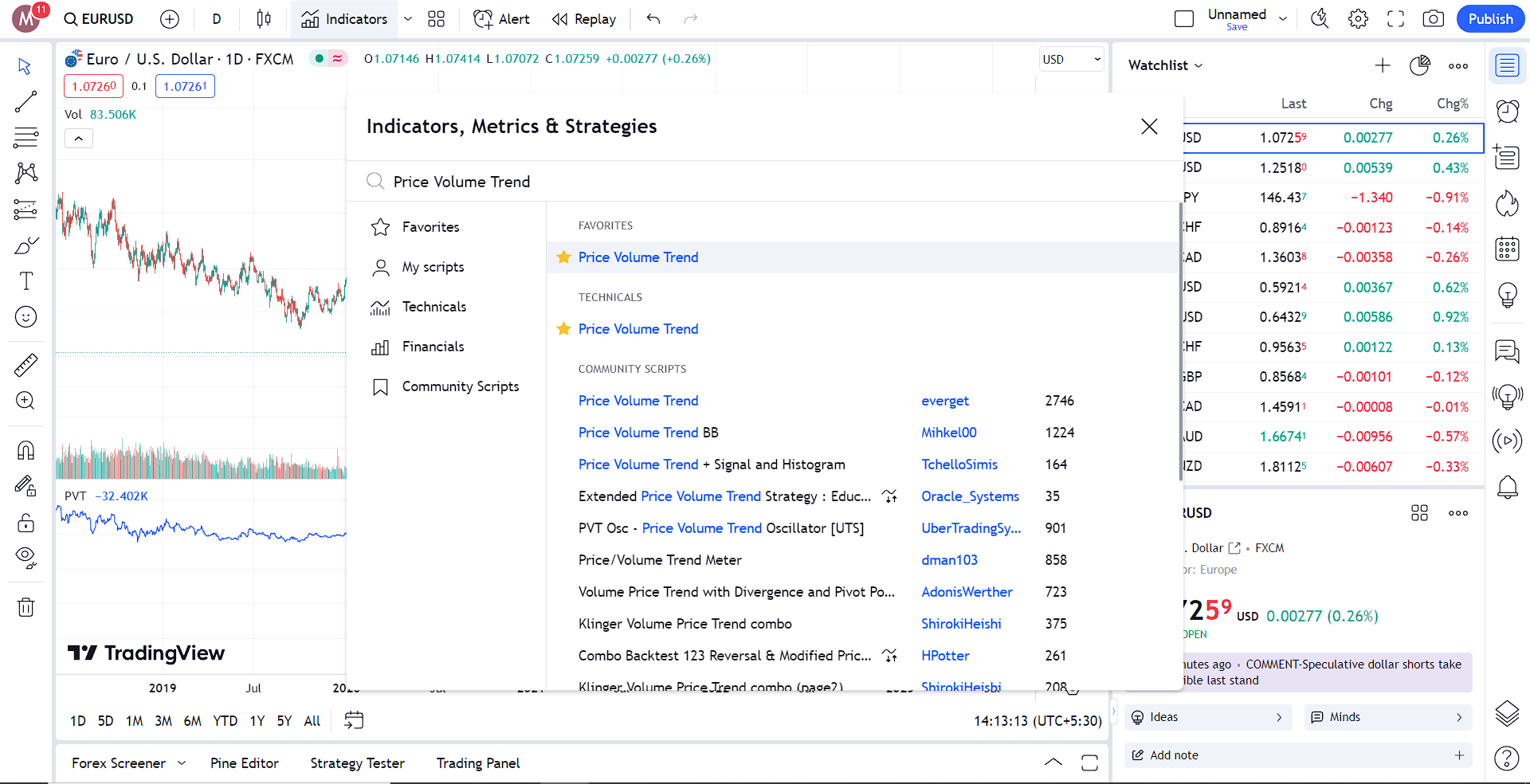

The Volume Price Trend (VPT) is a hybrid technical indicator that combines the price change and trading volume. It was developed by David M. Vomund in the late 1970s. In the following image, you can see how this indicator looks in Tradingview.

Calculating the Volume Price Trend – The Formula:

This indicator is calculated by adding up the value of volume multiplied by price change.

VPT = VPT Previous + Volume * Price Change

VPT = VPT Previous + (Volume * [(Closing Price – Closing Price Previous) / Closing Price Previous])

Now, let us take a look at an example calculation-

Suppose we have the following data for a stock:

- Day 1: Closing Price = $50, Volume = 100,000 shares

- Day 2: Closing Price = $52, Volume = 120,000 shares

- Day 3: Closing Price = $54, Volume = 150,000 shares

First, we need to calculate the VPT for Day 1, which is usually set to zero as there’s no previous data. So, VPT(1) = 0.

Next, we calculate VPT for Day 2:

VPT(2) = VPT(1) + (120,000 * [(52 – 50) / 50]) = 0 + (120,000 * [0.04]) = 4,800

Now, let’s calculate VPT for Day 3:

VPT(3) = VPT(2) + (150,000 * [(54 – 52) / 52]) = 4,800 + (150,000 * [0.0385]) ≈ 10,725

Interpreting the Volume Price Trend:

We are looking at the direction of the VPT indicator rather than its value. If the price of the asset decreases, the price change will be negative; therefore, VPT will decrease. Conversely, if the price of the asset increases, the price change will be positive, and VPT will increase.

Trading strategies with the VPT:

- Signal Line Crossover – We can apply a moving average to the VPT line as a signal line. If the VPT line crosses the signal line from below to above, this is considered a bullish signal. Conversely, if the VPT line crosses the signal line from above to below, it is considered a bearish signal.

- Spotting the Divergence – Divergence occurs when there is a disparity between the price chart and the indicator. This signals weakening of the current momentum and a potential trend reversal.

Using Volume Price Trend Indicator with the Trading View:

Goto Indicators , then search for ” Price Volume Trend”. Then click on the name of indicator to insert it into the chart.

Conclusion:

The Volume Price Trend (VPT) is a technical indicator calculated by multiplying the volume with the corresponding price change. If the price change is positive, the indicator will rise; if the price change is negative, the indicator will fall. It is important to keep in mind that signal line crossover signals are less reliable and often produce false signals. Therefore, never use this indicator alone to enter trades. Always confirm entries with other technical indicators or trading methods before placing a trade.

References:

https://en.wikipedia.org/wiki/Volume%E2%80%93price_trend

https://www.daytrading.com/volume-price-trend

Explore our Algorithmic Trading Courses:

Cryptocurrency Investing with Python | Earn Passive Income !

Code your own Bot with Python to Automate Crypto Investing in Binance. Upload Him to a Server and He Will Do the Rest !

4.9 Rating

2.5 Hours

1.5K+

$119.99

$13.99

Binance Futures Trading with Python | Build a Market Maker Bot

Unlock the power of automated trading with Binance Futures and Python. Maximize profits with tech & expertise in trading

4.9 Rating

2.5 Hours

1.2K+

$119.99

$13.99

Forex Algorithmic Trading with Python : Build a Grid Bot

Create your own profitable Grid Bot with Python. He can trade many currency pairs at once. With free Bot included !!

4.9 Rating

3 Hours

1.5K+

$119.99

$13.99

Master Forex News Trading with Python | The Secret Strategy

Build an Automated Trading Bot to Capture the Volatility of News Events-with Semi Intelligent Take Profit and Stop Loss

4.9 Rating

2.5 Hours

1.2K+

$119.99

$13.99

Binance Futures Trading with Python | Build a Martingale Bot

Stop wasting time on Paid trading Bots – Create your own Binance Futures Bot and take control of your trading strategy !

4.9 Rating

2.5 Hours

1.5K+

$119.99

$13.99

The Complete Foundation Binance Algorithmic Trading Course

Binance Algorithmic Trading from A-Z | Spot and Futures trading, Build Strategies, Automate with Cloud Server + More

4.9 Rating

4 Hours

1.5K+

$119.99

$13.99

Forex Algorithmic Trading with Python : Build a DCA Bot

Create your own profitable DCA Bot with Python. He can trade many currency pairs at once. With free Bot included !!

4.9 Rating

3 Hours

1.5K+

$119.99

$13.99

The Ultimate Forex Algorithmic Trading Course | Build 5 Bots

Build your own SMA Crossover Bot, Bollinger Bands Trading Bot , Grid Bot, DCA Bot and a Basic Bot to learn Fundamentals

4.9 Rating

4 Hours

1.5K+