Introduction to Chaikin Money Flow (CMF) Indicator:

The Chaikin Oscillator is developed by Mark Chaikin. This oscillator measures the flow of capital into or out of an asset over a specific period of time, usually 20 or 21 periods. It consists of a single line that fluctuates around zero. Values above 0 indicate capital inflow into the asset, while values below 0 indicate capital outflow from the asset. This oscillator usually fluctuates between +0.5 and -0.5. Values above +0.20 indicate overbought conditions, while values below -0.2 indicate oversold conditions in the market.

Calculation of the Chaikin Money Flow – The Formula:

The Money Flow Multiplier is calculated as follows:

Money Flow Multiplier = [(Close – Low) – (High – Close)] / (High – Low)

Then Money Flow Volume is calculated:

Money Flow Volume = Money Flow Multiplier x Volume

The formula for calculating Chaikin Money Flow is as follows:

CMF = (Sum of Money Flow Volume for the Period) / (Sum of Volume for the Period)

Interpreting the Chaikin Money Flow Indicator:

In this formula, “Close” refers to the closing price, “Low” is the lowest price of the period, and “High” is the highest price of the period. CMF values oscillate around a zero baseline. Positive CMF values indicate buying pressure, suggesting that the price closed higher than the midpoint of the day’s trading range with high volume. Negative CMF values suggest selling pressure, indicating that the price closed lower than the midpoint with high volume.

Trading strategies with the Chaikin Money Flow (CMF) indicator:

- Spotting Overbought and Oversold Conditions: When the value of the CMF indicator is above +0.2, it is usually considered an overbought signal, indicating that the current uptrend is likely to end and a potential bearish reversal may occur. Conversely, when the value of the CMF indicator falls below -0.2, it is typically regarded as an oversold signal, suggesting that the current downtrend is approaching its conclusion and a potential bullish reversal could be on the horizon. These signals gain greater reliability when applied to higher time frames (e.g., 4h).

- Spotting Divergence: Divergence in trading is a signal that occurs when the price of an asset doesn’t match the movement of an indicator. It can suggest a potential trend reversal or change in market direction. There are four types of divergence.

- Regular Bullish Divergence: This occurs when the price chart of the asset forms lower lows while the oscillator forms higher lows. This indicates that despite the downward momentum of the price, the selling strength is weakening, signaling a potential bullish reversal.

- Regular Bearish Divergence: This takes place when the price chart of the asset forms higher highs while the oscillator forms lower highs. It indicates that despite the upward momentum of the price, the buying strength is weakening, signaling a potential bearish reversal.

- Hidden Bullish Divergence: Bullish hidden divergence occurs when the price chart of an asset forms a higher low, while the oscillator forms a lower low. This indicates that even though the price is showing a temporary pullback or correction in an ongoing uptrend,the uptrend is likely to continue after the pullback.

- Hidden Bearish Divergence: Bearish hidden divergence occurs when the price chart of an asset forms a lower high, but the oscillator forms a higher high. This indicates that despite the price showing a temporary bounce or correction in an ongoing downtrend, the downtrend is likely to continue after the bounce.

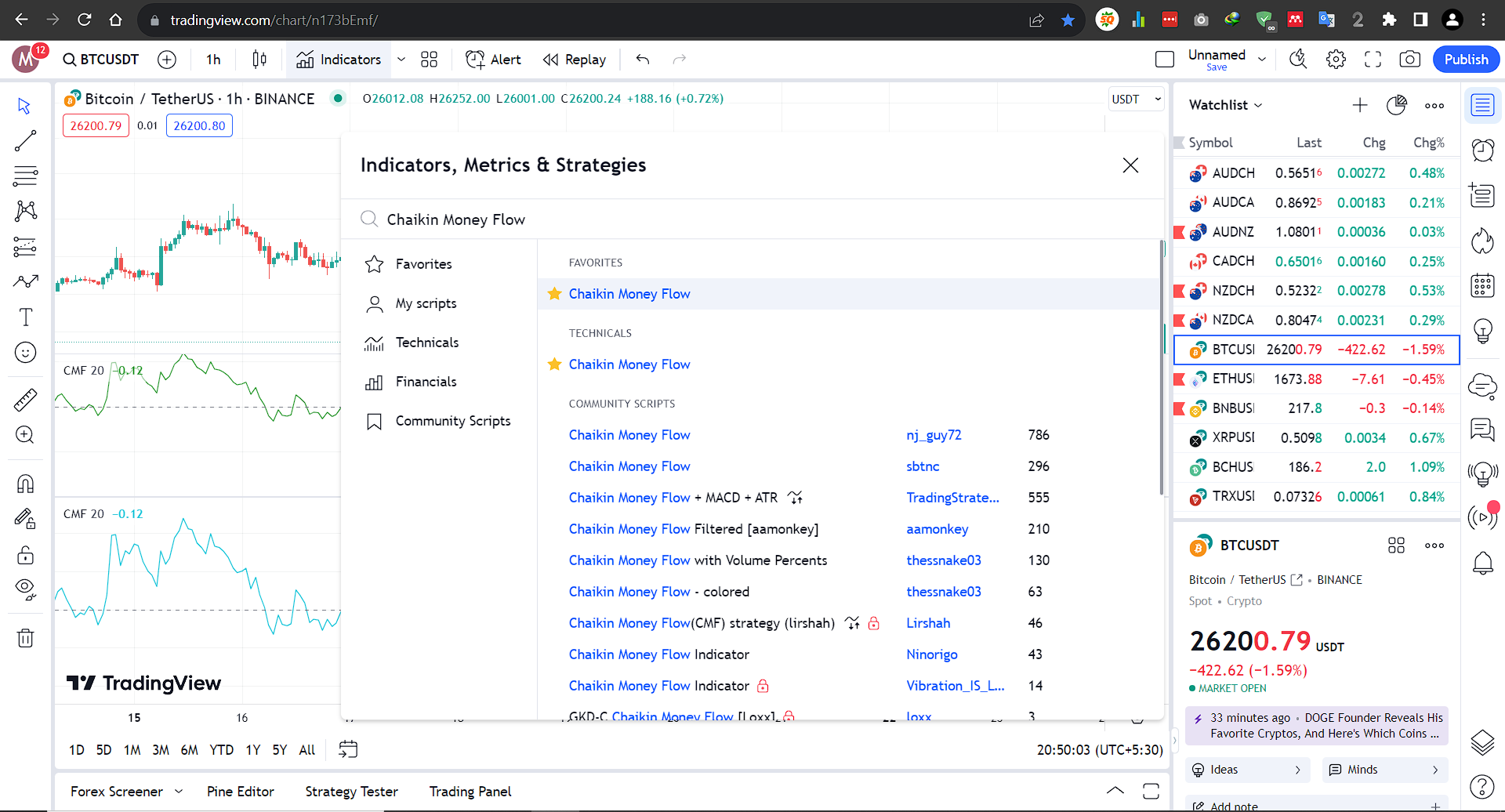

Using the Chaikin Money Flow (CMF) Indicator with TradingView:

Goto Indicators, then search for “Chaikin Money Flow” Click on the name of indicator to insert it into chart

Conclusion:

In conclusion, the Chaikin Money Flow (CMF) Indicator, reveals capital dynamics via price and volume. While not a foolproof solution, it uncovers trends and overbought/oversold conditions.

It is important to keep in mind that signals provided by the indicator are not always correct. It can also provide false signals. We can minimize the occurrence of false signals by combining this indicator with others and employing additional trading methods, such as support and resistance analysis, trendline breakouts, and more.”

Explore our Algorithmic Trading Courses:

Cryptocurrency Investing with Python | Earn Passive Income !

Code your own Bot with Python to Automate Crypto Investing in Binance. Upload Him to a Server and He Will Do the Rest !

4.9 Rating

2.5 Hours

1.5K+

$119.99

$13.99

Binance Futures Trading with Python | Build a Market Maker Bot

Unlock the power of automated trading with Binance Futures and Python. Maximize profits with tech & expertise in trading

4.9 Rating

2.5 Hours

1.2K+

$119.99

$13.99

Forex Algorithmic Trading with Python : Build a Grid Bot

Create your own profitable Grid Bot with Python. He can trade many currency pairs at once. With free Bot included !!

4.9 Rating

3 Hours

1.5K+

$119.99

$13.99

Master Forex News Trading with Python | The Secret Strategy

Build an Automated Trading Bot to Capture the Volatility of News Events-with Semi Intelligent Take Profit and Stop Loss

4.9 Rating

2.5 Hours

1.2K+

$119.99

$13.99

Binance Futures Trading with Python | Build a Martingale Bot

Stop wasting time on Paid trading Bots – Create your own Binance Futures Bot and take control of your trading strategy !

4.9 Rating

2.5 Hours

1.5K+

$119.99

$13.99

The Complete Foundation Binance Algorithmic Trading Course

Binance Algorithmic Trading from A-Z | Spot and Futures trading, Build Strategies, Automate with Cloud Server + More

4.9 Rating

4 Hours

1.5K+

$119.99

$13.99

Forex Algorithmic Trading with Python : Build a DCA Bot

Create your own profitable DCA Bot with Python. He can trade many currency pairs at once. With free Bot included !!

4.9 Rating

3 Hours

1.5K+

$119.99

$13.99

The Ultimate Forex Algorithmic Trading Course | Build 5 Bots

Build your own SMA Crossover Bot, Bollinger Bands Trading Bot , Grid Bot, DCA Bot and a Basic Bot to learn Fundamentals

4.9 Rating

4 Hours

1.5K+